Biden And McConnell Have Left Our Strategic Petroleum Reserve In Worse Shape Than You Think

Over the past few months, a great deal of attention has been focused on the Biden administration’s decision to draw down the Strategic Petroleum Reserve (SPR), a blatant attempt to manipulate the price of oil to desperately drive down gasoline prices at the pump.

This decision was purely political, and it represents a new low in American politics — the blatant use of publicly owned, strategic resources to sway votes in this year’s midterm elections. Although gasoline prices have declined modestly since this policy was enacted in March, this decision, in conjunction with other legislation passed by this administration, has left the United States oil reserve in an extremely precarious position.

When President Joe Biden was sworn into office in late January 2021, SPR inventories stood at 638,086,000 barrels. In the most recent U.S. Energy Information Agency (EIA) report dated Nov. 11, 2022, SPR inventories have declined to 392,119,000 barrels, a drop of 245.97 million barrels (-38.55 percent).

With this decline to fewer than 400 million barrels, SPR reserves now stand at their lowest level since late March 1984. However, these headlines fail to tell the truth about Biden’s effort to deplete the SPR — which now essentially stands at about 100 million barrels, some 75 percent less than the “official” EIA inventory number. Let me explain.

In August 2022, Biden, in collaboration with House Democrats and feckless Republican Senate leadership, passed and signed into law HR 3684, otherwise known as the Infrastructure Investment and Jobs Act. This bill passed the House of Representatives on a 228-205 vote, with all 220 Democrats and 8 Republicans voting in favor. In the Senate, this bill passed on a 69-30 vote (Sen. Mike Rounds of South Dakota did not vote), with support from all 50 Democrats and 20 Republicans, including support from the entire Senate Republican leadership (Sens. Mitch McConnell, John Thune, and Mike Crapo).

Tucked away in this monstrous bill (see page 914) was authorization mandating that the secretary of energy, “shall draw down and sell from the Strategic Petroleum Reserve 87,600,000 barrels of crude oil during the period of fiscal years 2028 and 2031.” The bill further added, “Amounts received from the sale … shall be deposited in the general fund of the Treasury during the fiscal year in which the sale occurs.”

In other words, in order to pay for a portion of this $1 trillion in new spending, this law requires the additional sale of oil from the SPR. And by legislating this “trick,” the Congressional Budget Office (CBO) “score” improved, giving the appearance that the infrastructure bill would be less costly to the American taxpayer. However, this was not the first time Biden has used the sale of oil from the SPR to offset a portion of his profligate spending during his tenure as president or vice president.

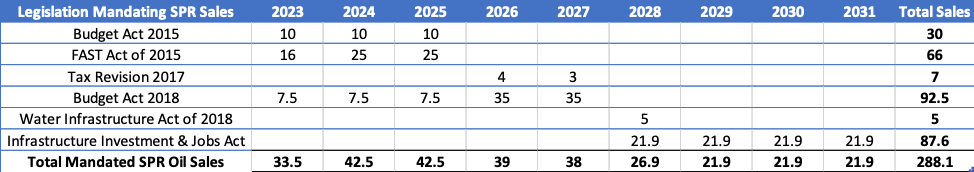

The genesis for this budget chicanery began in the late stages of the Obama administration. In October 2015, the Obama-Biden administration worked with the same Senate Republican leadership to pass the Bipartisan Budget Act of 2015. This act raised the debt ceiling, increased discretionary spending in fiscal years 2016 and 2017, and averted a potential government shutdown. Tucked in this bill was a mandate to sell 58 million barrels of oil from the SPR during fiscal years 2018-2025. Once again, this act was shepherded through the Senate under the leadership of Majority Leader Mitch McConnell.

Not to be outdone, the Obama-Biden administration dipped into this well a second time with the passage of the 2015 FAST Act in December 2015. This bill mandated the sale of 66 million barrels of SPR oil during fiscal years 2023-2025. And once again, the bill was moved through the Senate by McConnell.

Subsequent pieces of legislation including the 2017 Tax Revision Act, the Bipartisan Budget Act of 2018, and America’s Water Infrastructure Act of 2018 also followed suit authorizing the sale of an additional 104.5 million barrels of oil from the SPR. All told, mandated SPR oil sales from these various laws now total 358.6 million barrels, of which 288.1 million barrels have yet to be sold.

And with the Biden administration extending its SPR sales by an additional 15 million barrels in mid-October, the current SPR inventory will soon decline to fewer than 380 million barrels. However, when future legislatively mandated sales of 288.1 million barrels are included, America’s strategic oil inventory will soon fall to fewer than 100 million barrels, a supply of just 5.3 days given our daily use rate of 18.68 million barrels.

Although the Biden administration recently announced its intention to refill the SPR if oil prices fall to $67-$72, this pledge rings hollow. For the past several years, the endless pursuit of environmental, social, and governance (ESG) policies and the anti-fossil fuel sympathies of the Biden administration have severely curtailed investment in oil patch. Additionally, the establishment of a new floor price for crude oil will not precipitate American oil producers to increase production. Even if new oil reserves are discovered and developed, roughly 5 to 7 percent of world production must be replenished each year, just to offset the natural rate of depletion from existing wells.

Given the numerous production/supply headwinds, world oil prices have remained range-bound between $80 to $100 per barrel, despite extremely sluggish Chinese demand (as they continue rolling Covid lockdowns). And once the roughly 1 million barrels a day of supply from U.S. SPR sales are removed from the world market, oil prices are not likely to head much lower.

Unless oil is added to the SPR, America’s emergency supply of oil in the case of war or a major national disaster will remain at dangerously low levels for the foreseeable future. Let us hope that the short-sighted policies enacted by our current president and our go-along-to-get-along Senate minority leader do not jeopardize American economic and national security any further.

Paul Matthews is a Texas-licensed Certified Public Accountant and CFA charter holder. Paul began in the agriculture trading pits at the Chicago Board of Trade and worked as a derivatives research analyst before starting a long/short equity hedge fund. He currently serves as the CFO for a foundation based in Northern Virginia. He is the father of two boys and holds an MBA from the University of Texas in Austin.

Comments are closed.