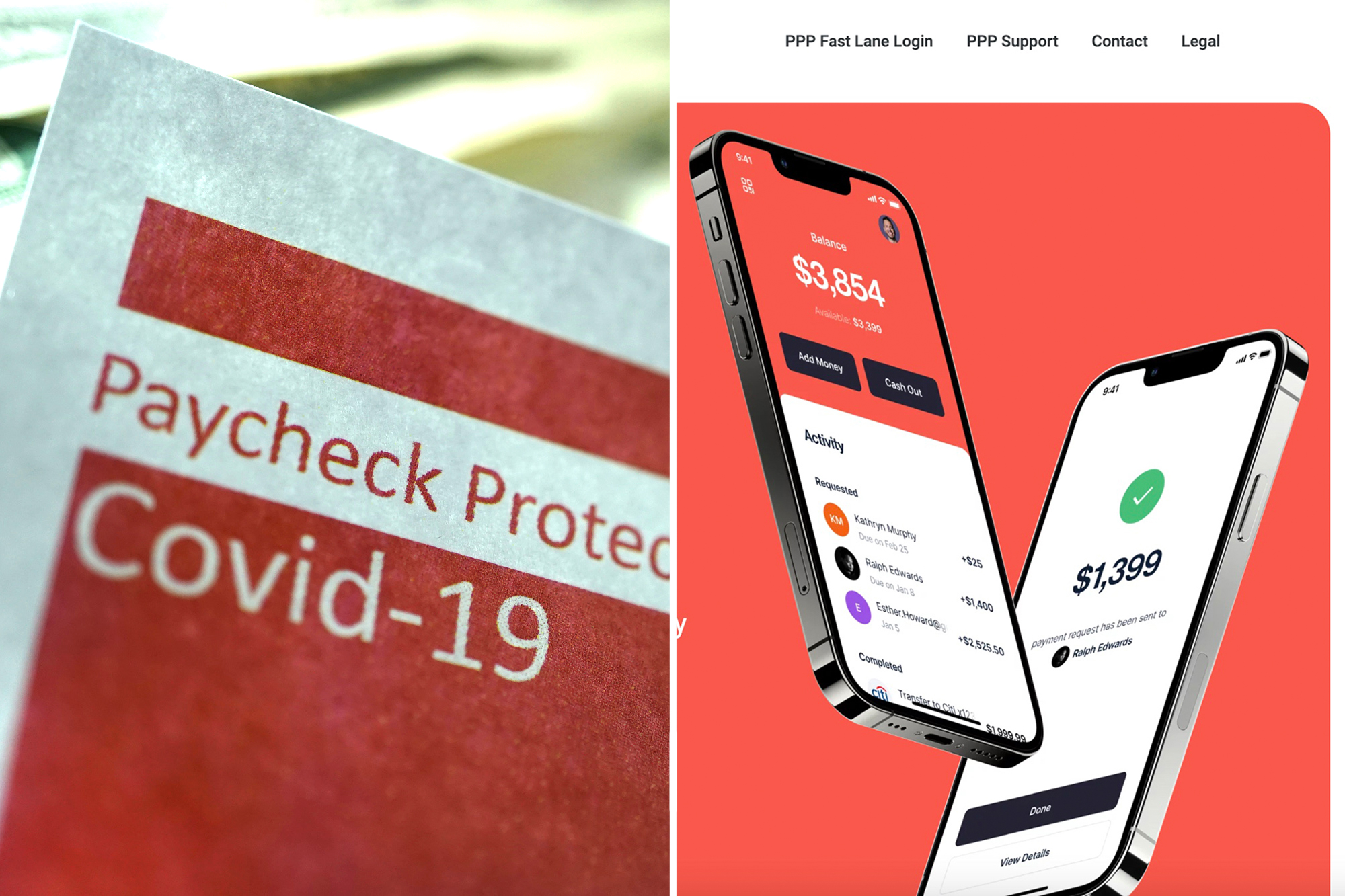

Fintech Firms Oversaw Billions in Fraudulent Covid Aid Loans, Report Says; Tech Firms Defrauded Feds by Brokering Shady PPP Loans to Collect Fees: Report, and other C-Virus related stories

WSJ: Fintech Firms Oversaw Billions in Fraudulent Covid Aid Loans, Report Says:

Congressional report blames the companies for high volume of fraud in the Paycheck Protection Program

Financial technology companies oversaw a disproportionately high rate of fraudulent loans through the Paycheck Protection Program authorized by Congress to provide small business loans during the Covid-19 pandemic, a new congressional report says.

The report by the House Select Committee on the Coronavirus Crisis says “at least tens of billions of dollars” from the federal loan program overseen by financial technology firms were likely given to applicants who were fraudulent or ineligible.

Two of the firms, Womply and Blueacorn, facilitated nearly one in every three loans from the Paycheck Protection Program in 2021, based on the report. The companies didn’t set up systems that were able to detect or prevent fraud or ineligible applications, the report says.

Blueacorn received more than $1 billion in taxpayer-funded processing fees for its work on the Paycheck Protection Program, but spent less than 1% of that amount—$8.6 million—on its fraud prevention program, according to the report. Blueacorn’s founders arranged Paycheck Protection Program loans for themselves through Blueacorn, some of which show signs of potential fraud, the report says.

Blueacorn didn’t immediately return an email seeking comment.

Womply in 2021 saw a net revenue of over $2 billion, which largely came from processing fees in the Paycheck Protection Program. The business took over $5 million in loans from the same program for itself, the report says. The Small Business Administration later determined Womply was ineligible to receive the loans, according to the report. —>READ MORE HERE

Tech firms defrauded feds by brokering shady PPP loans to collect fees: report

Financial tech companies that were acting as go-betweens to facilitate the issuance of emergency loans during the early stages of the coronavirus pandemic defrauded the federal government out of large sums of money, according to a report.

A congressional report cited by The Washington Post names at least three companies — Blueacorn, Womply and Kabbage — that are alleged to have bilked the government as it frantically sought to keep the economy afloat at the start of the COVID lockdowns in the spring of 2020.

The companies were initially tasked with helping PPP loan applicants file paperwork with financial institutions and process requests for emergency cash.

But the firms are alleged to have taken advantage of the lack of governmental oversight to squeeze more money out of the $800 billion Paycheck Protection Program (PPP).

Blueacorn, the Arizona-based fintech firm that “connects technology and financial expertise to help small businesses, independent contractors, self-employed individuals and gig workers with their financial needs,” is alleged to have pressured loan reviewers to “push through” PPP loans even if they seemed dubious in nature. —>READ MORE HERE

Follow links below to relevant/related stories and resources:

Why this doctor applauds Elon Musk ending Twitter’s COVID ‘misinformation’ ban

California’s COVID-19 ‘Misinformation’ Law

USA TODAY: Coronavirus Updates

YAHOO NEWS: Coronavirus Live Updates

NEW YORK POST: Coronavirus The Latest

Comments are closed.