Don’t Blame Depositors For Bank Failure, Blame Biden And SVB Management

It’s important to understand that SVB’s failure didn’t arise from risky startups doing risky startup things.

It’s painful for me to watch so many smart pundits and politicians on both the right and the left buy into a media narrative that seeks to blame “wealthy speculators” or “tech bros” or venture capitalists for a banking crisis that ultimately started in Washington. Let me explain.

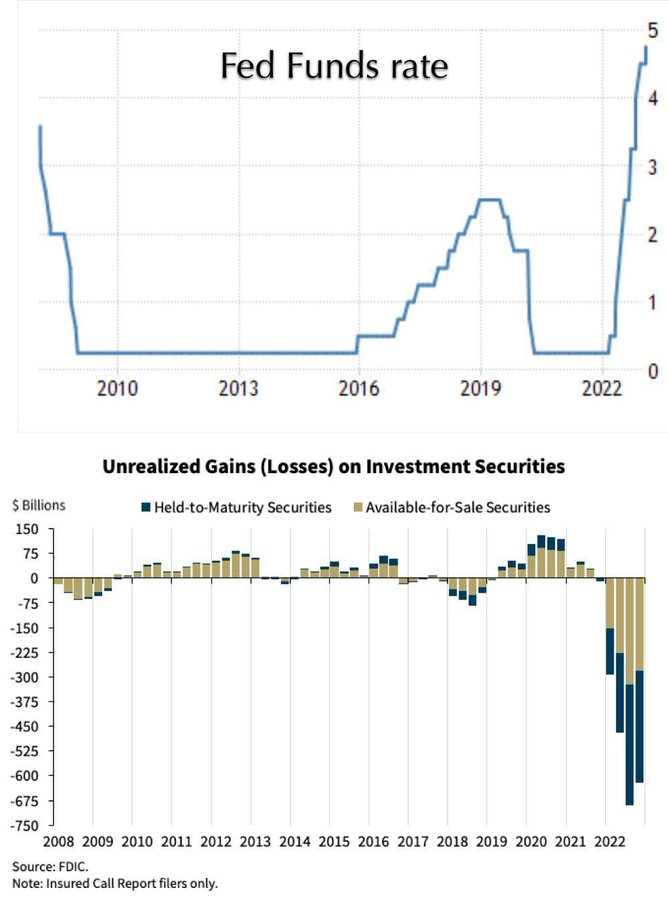

If you want to understand the context for the crisis, look at the Federal Deposit Insurance Corporation chair’s March 6 testimony — a week before Silicon Valley Bank’s collapse — where he explains that banks were sitting on $620 billion of unrealized losses from long-dated bonds. This provided the tinder for the crisis.

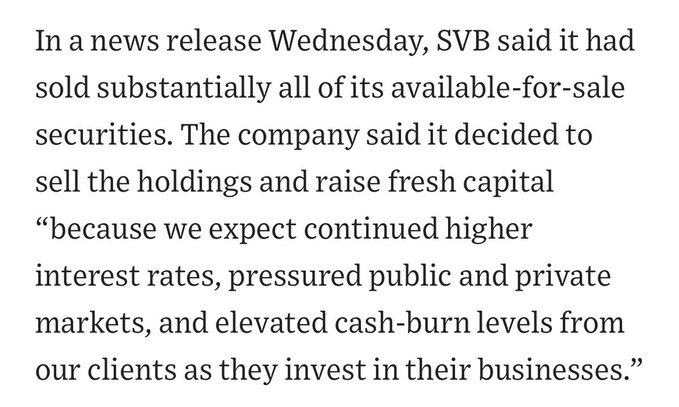

The match was lit when SVB announced on Wednesday, March 9, that it had effectively sold all of its available-for-sale securities and needed to raise fresh capital because of large unrealized losses from its mortgage bond portfolio.

On Thursday morning, the financial press widely reported SVB’s need for new capital, and short sellers were all over the stock. The CEO’s disastrous “don’t panic” call later that morning only heightened fears and undermined confidence in the bank.

The idea that one needed “non-public information” to understand that SVB was at risk is drivel being peddled by populist demagogues. Any depositor who could read The Wall Street Journal or watch the stock ticker could understand there was no upside in waiting to see what would happen next.

By Friday, the run on other banks had begun. This became abundantly clear when regulators placed Signature Bank in receivership, announced a backstop facility for First Republic, and temporarily halted trading of regional bank stocks on Monday. Even trading of Schwab was halted.

Some unscrupulous reporters and political types have even claimed that I somehow caused this through my tweeting. Dang, they must think I’m Superman! Or maybe E.F. Hutton. But the timing doesn’t line up at all, as I already explained.

Once the run on the bank started, decisive action by the Fed was imperative. This meant protecting deposits (uninsured are 50 percent) and backstopping regional banks. No matter how distasteful you may find those things to be, preventing a greater economic calamity was necessary.

But back to SVB: Its collapse was first and foremost a result of its own poor risk management and communications. It should have hedged its interest rate risk. And it should have raised the necessary capital months ago through an offering that didn’t spook the street.

SVB doesn’t deserve a bailout and isn’t getting one. SVB’s stockholders, bondholders, and stock options are getting wiped out. The executives will spend years in litigation and may have stock sales clawed back. Anyone who thinks there’s a “moral hazard” isn’t paying attention.

But it’s important to understand that SVB’s failure didn’t arise from risky startups doing risky startup things. It arose from SVB’s over-exposure to boring old mortgage bonds, which were considered safe at the time SVB bought them. Perhaps this is why SVB had an “A” rating from Moody’s and had passed all of its regulatory exams.

What turned the mortgage bonds toxic? The most rapid rate-tightening cycle we’ve seen in decades. You can see the connection here between rapid rate hikes and unrealized losses in the banking system.

So what caused the rapid rate hikes? The worst inflation in 40 years. And what caused that? Profligate spending and money printing coming out of Washington — all while Joe Biden, Janet Yellen, and Jerome Powell assured us inflation was “transitory.”

I warned two years ago that pumping trillions of dollars of stimulus into an already hot economy was an unprecedented and likely dangerous experiment. But this was Bidenomics.

So when Joe Biden says he’s going to hold those responsible for this mess fully accountable, he ought to start by looking in the mirror. But I’m sure that’s not going to happen, just as I’m sure the hunt for scapegoats is just beginning.

David Sacks is an entrepreneur and author who specializes in digital technology firms. He is a co-founder and general partner of the venture capital fund Craft Ventures and was the founding COO of PayPal.

Comments are closed.