Breitbart News economics editor John Carney said in an interview on Sunday morning’s Fox and Friends that the Chinese yuan is an “inevitable” and “serious threat” to the U.S. dollar being the world’s currency.

Discussing the Chinese yuan possibly being a threat to the U.S. dollar and hindering the ability of the dollar to be the currency of the world, Carney told the host that he believes it is “inevitable” and it is a “serious threat.”

Carney also agreed with the host that the U.S. dollar has gone through three stages since World War II: when the U.S. was the biggest economy in the world, when the dollar took over global banking, and after the fall of the Soviet Union when the “entire world more or less came under the domination of the U.S. dollar.”

However, he noted that the U.S. dollar is now “drifting away” as China and Russia are “starting to build an alternative block of currencies.”

Carney further explained that the alternative block of currencies could lead to a fractured global market of currencies in the future, like on a “Cold War basis,” with “different blocks of economies in different blocks of currencies.”

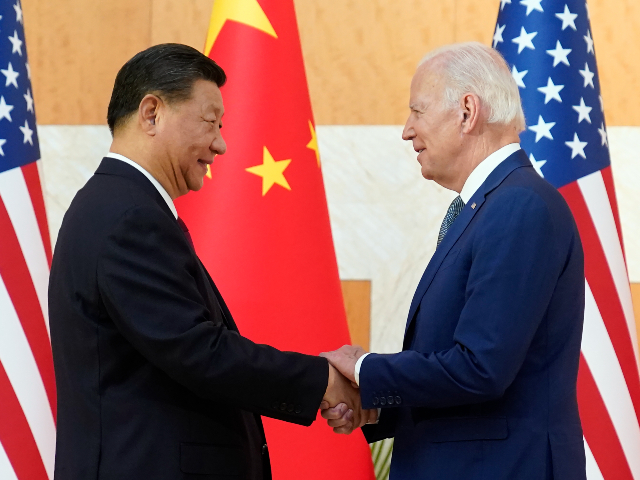

U.S. President Joe Biden, right, and Chinese President Xi Jinping shake hands before their meeting on the sidelines of the G20 summit meeting, Nov. 14, 2022, in Nusa Dua, in Bali, Indonesia. (AP Photo/Alex Brandon, File)

“But we are trying to have a smaller trade deficit with China. That’s one of the explicit goals of the United States policy right now,” he clarified. “If that happens, the trade deficit is what gives China so many dollars. That’s why they buy so many treasuries as we try to cut down on that trade deficit.”

“China naturally will have fewer dollars, which will mean that they need to move into a non-dollar-based system,” Carney added. “So this will benefit us as well. It’s part of our policy. It hasn’t been necessarily great for the U.S. economy to have the whole world work on dollars; it actually could end up being beneficial.”

However, when asked what his perspective is about the yuan as a “viable” option to the U.S. dollar and if he believes the “tipping point” could be dependent on what Saudi Arabia uses for their oil transactions, Carney explained that the Saudis want to more or less “diversify their portfolio.”

“They don’t know who’s going to win the contest for the world. And so they do want to make sure that they have some exposure to China and some exposure to the United States,” Carney asserted. “I don’t think, in the long run, that the yuan is actually a threat that it is ever going to become the dominant currency of the world because the Chinese Communist system is not open enough,” whereas the U.S. system is very open, and other countries trust the reserve currency is not going to be manipulated.

“We try to keep inflation very low. We haven’t done a good job of that in the last couple of years, but we have a 40-year track record of keeping inflation low and worked out doing it again. That gives the world a lot more security than China can,” Carney continued, motioning that Europe, Japan, and the Saudis, along with most of the other oil countries, would maintain a close relationship with the dollar, but there will eventually be some sort of “alternate blocks” in the future.

Jacob Bliss is a reporter for Breitbart News. Write to him at jbliss@breitbart.com or follow him on Twitter @JacobMBliss.

Comments are closed.