IRS Whistleblower Docs Show DOJ Obstructed Hunter Biden Probe To Protect President

The U.S. Department of Justice choked an IRS investigation and charging recommendations for Hunter Biden because it didn’t want to damage his father Joe Biden’s presidential chances, say whistleblower documents released today.

IRS whistleblower testimonies made available by the House Ways and Means Committee show Hunter should have been charged with several tax felonies and misdemeanors for evading taxes on millions of dollars of income but was ultimately given a sweetheart deal by the DOJ to protect his father.

“These payments are just a fraction of the total, but they provide insight into a world of wealth and influence that no ordinary American would recognize. And what plea deal did Mr. Biden just receive? A slap on the wrist for charges that have put other Americans behind bars. As I said, the federal government is not treating all taxpayers equally,” Committee Chairman Jason Smith said during a press conference on Thursday.

Earlier this week, the DOJ announced plans to charge the president’s youngest son with two federal misdemeanor counts for failing to pay his taxes and one federal felony charge for illegally possessing a gun while addicted to illicit drugs.

A carefully orchestrated plea deal between the DOJ and Hunter means the younger Biden will only face probation — not jail time — for the two misdemeanor tax charges. If a judge accepts the deal, Hunter will also avoid the maximum of 10 years in jail and a $250,000 fine that comes with a felony gun charge because the DOJ doesn’t plan to prosecute.

“When the American people read these transcripts, I think you’ll see a level of criminality that I don’t think anybody expected to see,” Rep. Darin LaHood, R-Ill., said at the press conference on Thursday.

LaHood also emphasized that “it is not a coincidence of the timing of what happened this week.”

“This could have been done a long time ago. It wasn’t,” he added.

Deliberate Obstacles At Every Turn

“I am blowing the whistle because the Delaware U.S. Attorney’s Office, Department of Justice Tax, and Department of Justice provided preferential treatment and unchecked conflicts of interest in an important and high-profile investigation of the President’s son, Hunter Biden,” IRS supervisory agent Gary Shapley said in his testimony.

Accumulating evidence shows exactly what Shapley alleged: the DOJ gave Hunter Biden “preferential treatment,” “slow-walked the investigation,” and “did nothing to avoid obvious conflicts of interest.”

The IRS first began investigating Hunter in 2018 in connection to a “foreign-based amateur online pornography platform.” When the FBI confirmed it was Hunter’s laptop in November 2019, the IRS asked to look at laptop materials to seek evidence for potential tax crimes, but FBI officials choked its attempts to sift through the materials.

By April 2020, Shapley, the supervisor of the Hunter case, was armed with affidavits to seek search warrants for the laptop and planned to conduct approximately 15 related interviews with potential witnesses. Instead of granting the IRS permission to execute any of these tools, DOJ officials dragged their feet, effectively denying them, he said. Shapley says that’s because this was the same month President Joe Biden “became the presumptive Democratic nominee for President.”

By June 2020, Shapley raised red flags about this cross-agency stifling to his supervisor, who decided the IRS should ultimately submit to the DOJ’s stifling of their investigation into Hunter. For the next two years, Shapley and his team uncovered new evidence of Biden corruption but could not act on it because of DOJ resistance.

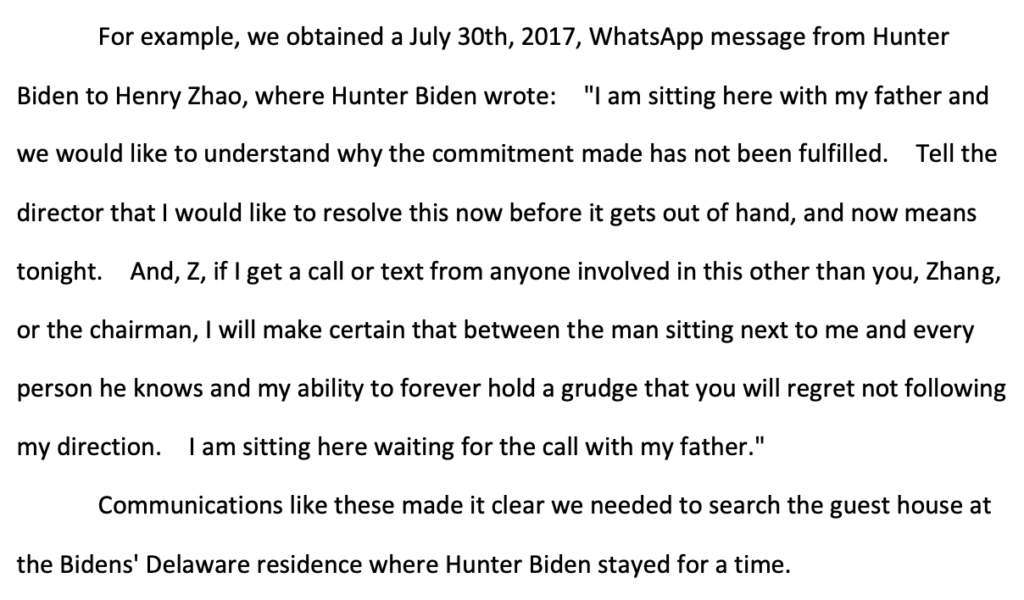

In one such case, Shapley’s team uncovered a message from Hunter’s WhatsApp to a Chinese communist party official Henry Zhao. The angry text shows the younger Biden, “sitting here with my father,” demanding a presumably financial “commitment” be fulfilled “before it gets out of hand.”

Shapley said this message indicated the IRS should “search the guest house at the Bidens’ Delaware residence where Hunter Biden stayed for a time.” Assistant United States Attorney Lesley Wolf agreed that “there was more than enough probable cause for the physical search warrant there” but blamed “optics” as the reason for the eventual denial.

In addition to obstructing key steps in the IRS’s investigation into Hunter, DOJ prosecutors also overlooked concerns about ethics and tried to remove Hunter’s name from “electronic search warrants, 2703(d) orders, and document requests.”

At one point, investigators began looking into potential violations of the Foreign Agents Registration Act but were once again stifled by a lack of approval from the DOJ. A surprise IRS interview in December 2020 was similarly spoiled by the FBI which “had notified Secret Service headquarters and the transition team about the planned actions the following day.”

“This essentially tipped off a group of people very close to President Biden and Hunter Biden and gave this group an opportunity to obstruct the approach on the witnesses,” Shapley said, noting that the IRS only got one “substantive” interview out of 12 — with Biden family associate Rob Walker.

The IRS tried several times over the course of the years-long investigation to charge Hunter with the information they had but the DOJ disapproved of doing so near the 2020 election because it would hurt Biden’s presidential chances. When the IRS and U.S. Attorney David Weiss began to expand their potential charges to include Hunter’s financial behavior in 2014 and 2015, Shapley said the D.C. U.S. attorney refused to allow it.

“The purposeful exclusion of the 2014 and 2015 years sanitized the most substantive criminal conduct and concealed material facts,” Shapley warned.

A second whistleblower confirmed that anytime investigators tried to follow agency protocols and go public, “there were always times to where we were always on an impending election cycle.”

“It was always the election being brought up,” the whistleblower, whose name was redacted, said in his testimony.

The IRS finally recommended felony tax evasion charges for 2014, 2018, and 2019 and misdemeanor tax charges for 2015, 2016, 2017, 2018, and 2019 in January 2022. The DOJ made it clear that it did not concur with the recommendation.

As evidenced by the DOJ’s charges made public this week, only two of the five tax misdemeanor counts landed. None of the felony charges the IRS suggested would be announced or prosecuted.

As Shapley noted in his testimony, “The only win for me is to not be fired or arrested or retaliated against.”

Instead, Shapley said, “Since October 2022, IRS CI has taken every opportunity to retaliate against me and my team” including passing him over for a promotion “for which I was clearly most qualified” and sending threats that were “suppressing additional potential whistleblowers from coming forward.”

Even after IRS senior officials heard that Weiss and the DOJ were “acting improperly” they apparently granted a DOJ demand to remove the entire team from the Hunter Biden investigation.

Jordan Boyd is a staff writer at The Federalist and co-producer of The Federalist Radio Hour. Her work has also been featured in The Daily Wire, Fox News, and RealClearPolitics. Jordan graduated from Baylor University where she majored in political science and minored in journalism. Follow her on Twitter @jordanboydtx.

Comments are closed.