Breitbart Business Digest: Congrats! You’re ‘Resilient!’ Now Prepare for More Rate Hikes

Brace for Hikes

On Monday’s edition of the Breitbart Business Digest, we flagged that signs of a housing recovery could be a green light for the Federal Reserve to resume raising interest rates. An even clearer sign that the Fed could hike again emerged in the minutes from the Fed’s June meeting, which were released today. Even though rate hikes have paused for now, most Fed officials believe more tightening is coming.

Though the voting members of the Federal Open Market Committee agreed to keep the range steady between 5 percent and 5.25 percent, the minutes revealed that several nonvoting officials were prepared to raise rates in June, and nearly everyone is prepared to raise them more this year.

The buzzwords of the day were “resilient” and “resilience,” which appear throughout minutes. This comforting upbeat verbiage might serve to make Americans feel a little bit warmer and fuzzier as we see rates tick up yet again.

Bidenomics, a Tough Sell

It appears as though Joe Biden would like to leverage our collective economic “resilience” against his political rivals in the 2024 presidential election. This suits Biden, who will have no problem dishonestly claiming that he saved the economy from rival Donald Trump, even though the economic collapse at the end of Trump’s presidency was entirely due to the coronavirus and the lockdowns. The Democrats are also fond of trying to turn weaknesses into perceived strengths (Hillary Clinton and Russia is the most obvious recent example).

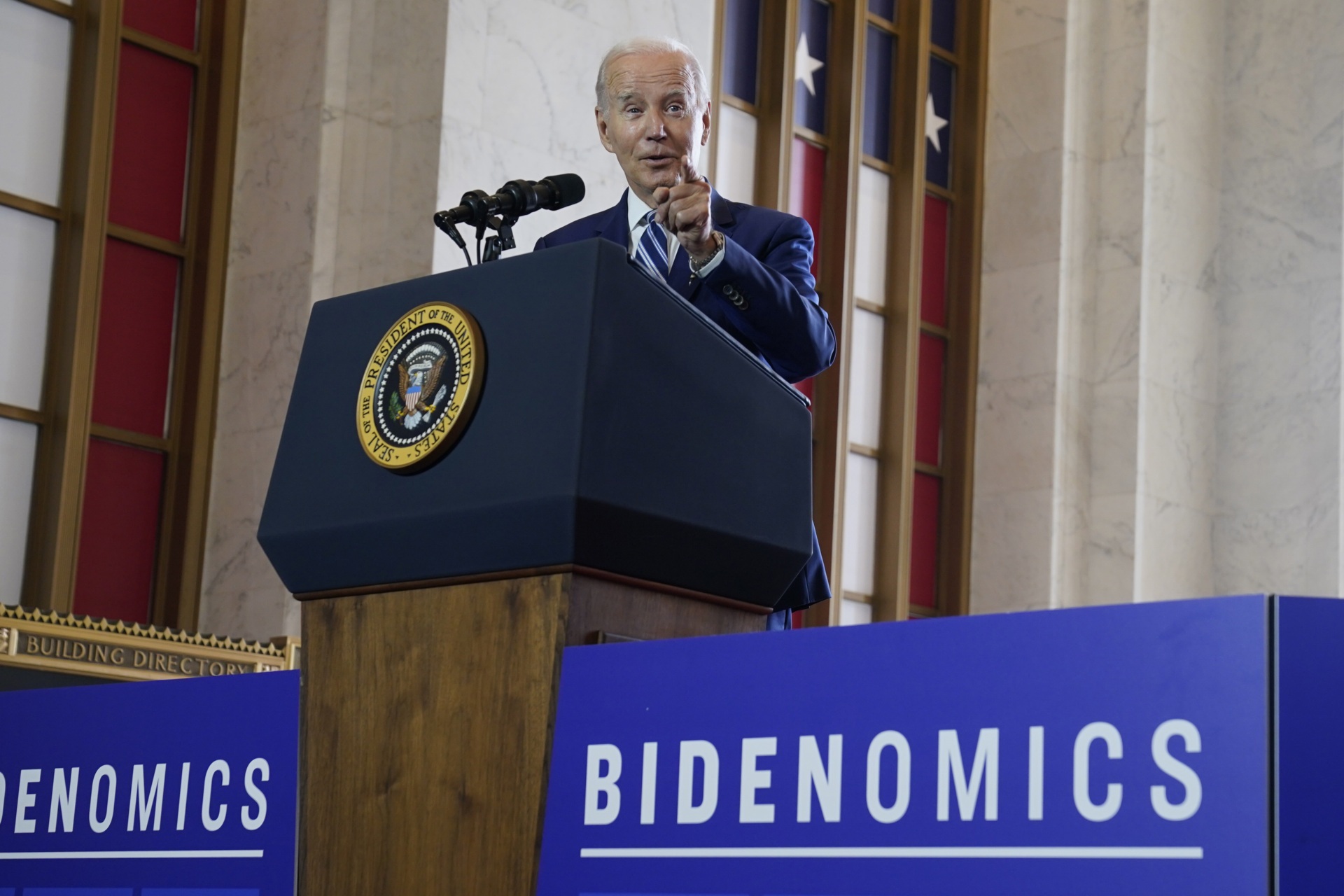

President Joe Biden delivers remarks on the economy on June 28, 2023, at the Old Post Office in Chicago. (AP Photo/Evan Vucci)

But, thus far, Americans are not buying it.

An AP-NORC poll released today, which was conducted between June 22 through 26, shows that the economy remains one of the weakest parts of Biden’s agenda. Only 30 percent of respondents see the economy as good, while 69 percent see it as poor. It is unclear how many see it as “resilient.”

Almost twice as many Americans disapprove of Biden’s management of the economy as approve of it. This number suggests that the general public is considerably more charitable to Biden’s mismanagement of the economy than we are at the BBD.

Social Media Cage Match: Zuck vs. Musk

Of all the inexplicable things Elon Musk does, his decision last week to limit the amount of tweets people can read on his platform is a real head-scratcher. The self-proclaimed “free speech absolutist” had rebranded Twitter as the most open major social media platform. Yet, late last week, he introduced a policy that requires web users to log in to Twitter to view tweets and then another policy that caps the amount of tweets active Twitter users can view. This isn’t just hypocritical for the online free speech guy, it also seems to contradict his mission to expand users and advertising dollars. Look for some of these new provisions to be reversed.

What may prove to be more noteworthy than the changes themselves is why they are being made. Perhaps, Musk is feeling extra pressure to shake things up because Meta is set to launch their Twitter competitor, called “Threads,” tomorrow.

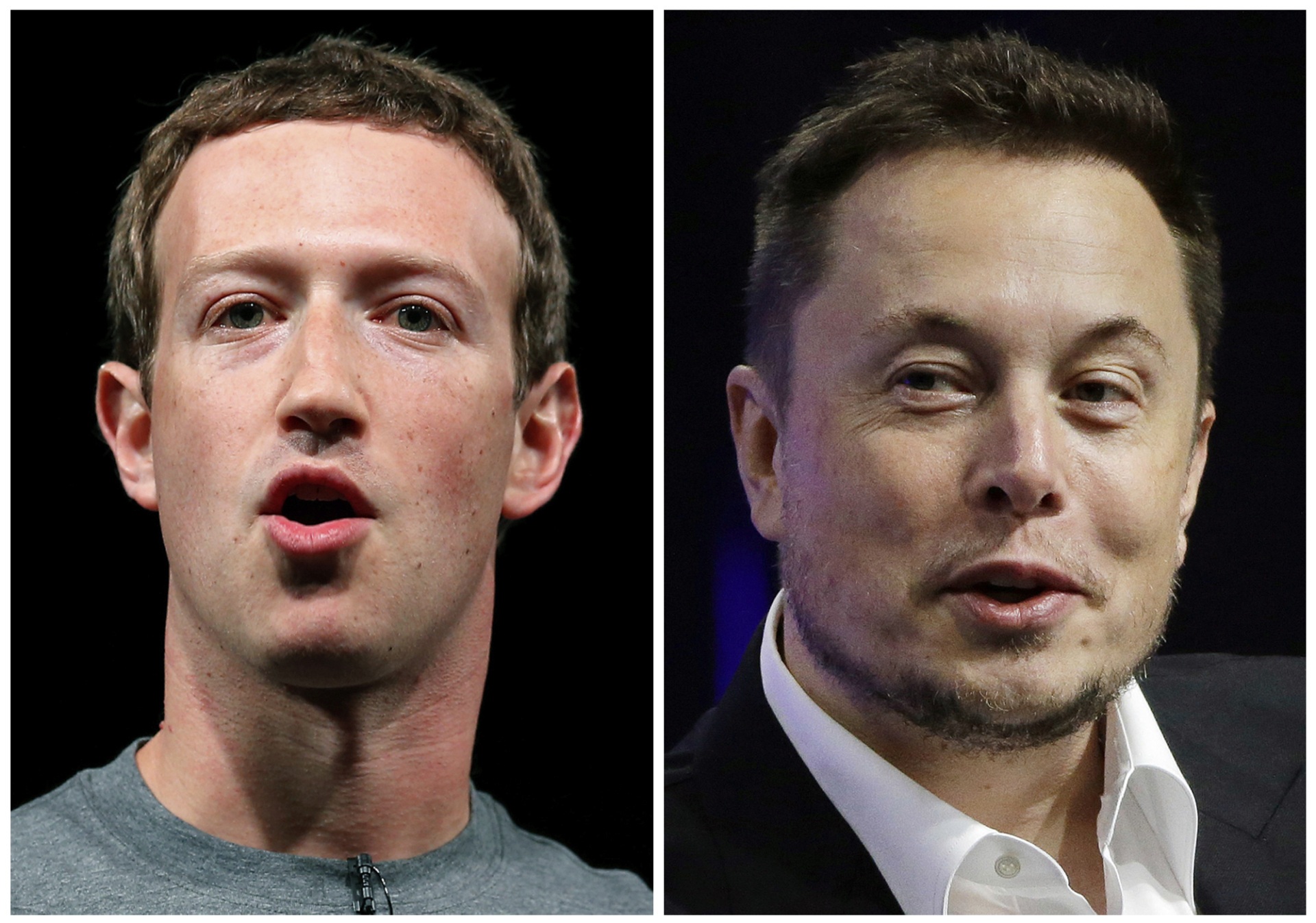

Meta CEO Mark Zuckerberg, right, and Twitter CEO Elon Musk. (AP Photo/Manu Fernandez, Stephan Savoia)

Fortunately for Twitter, Meta CEO Mark Zuckerberg is off to a bad start with the platform. First of all, the name is terrible. A “thread” is the worst part of Twitter; it is when you have to read ten or 20 or 30 or more consecutive tweets to get the full point of the “thread.” (In a bygone era, these “threads” were called articles or books and they were presented in more convenient formats for the reader.)

Second, news broke that Zuckerberg will be collecting a massive amount of data on user’s health, fitness, financial information, contact information, browsing history, and more. All of this is creepy and should be a huge turnoff to everyone, even those actively rooting against Musk and Twitter.

Still, the timing could be good for Zuckerberg, as social media users across the ideological spectrum like the idea of a fast-paced digital town square that is “sanely run.” Is Zuck the guy to do it? For now, we remain skeptical.

We will have all the latest on this battle, of course, at Breitbart.com.

Comments are closed.