CBO Report Illustrates The Cause Of Our Debt Problem: It’s The Spending, Stupid!

As it has often had to do over the past several years, the Congressional Budget Office (CBO) recently released a report illustrating the fiscal problems looming dead ahead for the United States. Its most recent analysis, an annual report estimating the long-term budget outlook, illustrated why Democrats’ “solution” to the problem — namely, massive tax increases — won’t solve our budgetary woes.

Record Spending, Record Debt

According to the CBO report, the federal government faces massive deficits over the next 30 years (the timespan of the analysis). Specifically, “deficits are projected to grow almost every year over the next three decades.” As a percentage of the economy, they would average more than twice the average deficit over the past half-century, growing to reach 10 percent of the entire economy in 2053.

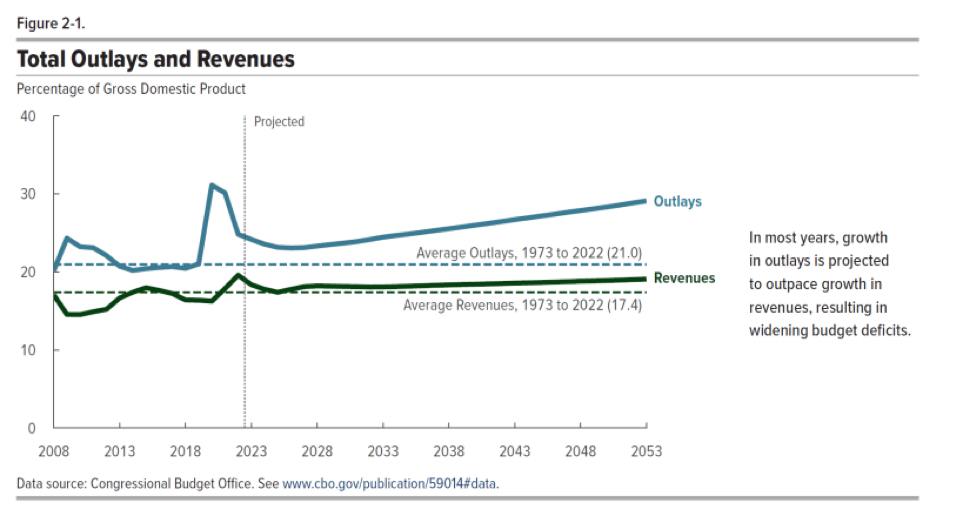

What will cause these deficits? As the CBO report notes, it’s not low levels of federal revenues. In fact, the budget gnomes believe that “revenues measured as a percentage of GDP are projected to be higher than they have been, on average, in recent decades.”

Instead, spending will drive our deficits. Federal outlays will reach levels seen only twice in our nation’s history: during World War II, and during the Covid lockdowns. Spending will rise faster than revenues almost every year, leading to greater and greater federal deficits.

Rising deficits will bring with it rising levels of debt. According to CBO, federal debt as a share of GDP will reach an all-time high in 2029, exceeding levels during and after World War II. But even after reaching 107 percent of the economy six years from now, the debt will rise still further, hitting 181 percent of GDP 30 years from now.

Impending ‘Doom Loop’?

All that debt will lead to higher interest costs, such that net interest costs will nearly triple over the coming three decades after they have already risen sharply over the past two years. By 2051, CBO estimates, we will pay more in interest on the national debt than we will spend on Social Security.

The combination of rising debt and rising interest payments raises the specter of a “doom loop.” In this scenario, the country will create ever-greater amounts of debt just to pay off interest costs — the national equivalent of paying $20 on a $1,000 credit card bill every month, such that the interest accumulates faster than the interest gets paid down.

If you’re thinking that the debt limit agreement House Speaker Kevin McCarthy, R-Calif., cut with President Biden has substantively changed the equation, think again. CBO concluded that the law would reduce the amount of debt held by the federal government as of 2033 by a measly 3 percent. And that assumes Congress actually sticks to the agreement’s spending caps, which it has rarely done in the past.

Likewise, the recent Supreme Court decision striking down some (but not all) of President Biden’s student “loan” giveaways will only make a partial dent in the mountain of debt the federal government faces.

Fiscal Cliffs Ahead

While its release just prior to the Independence Day holiday might make the CBO report irrelevant to some, events will soon make its projects very relevant. Roughly 18 months from now, the next president will face a series of events that will place our nation’s fiscal future front and center:

- Most of the provisions of the tax relief package Republicans passed in 2017 will expire at the end of 2025, creating a massive tax increase absent congressional action.

- Medicare and Social Security face looming insolvency, such that the next president and Congress will likely need to take action on one or both.

- Some would argue that the military needs significant rebuilding to combat a newly aggressive China and other threats worldwide.

- The economy could be in, or just recovering from, a recession caused to break the back of inflation (inflation exacerbated by profligate Democrat spending and the Federal Reserve printing money during the pandemic).

Beltway pundits are already looking to 2025 as a potentially revealing year in our nation’s fiscal trajectory. Let’s hope that between now and then, lawmakers read CBO’s analysis and take it to heart, by abandoning the notion that the United States can tax and spend its way to solvency, let alone prosperity.

Comments are closed.