Israel’s credit rating lowered by Morgan Stanley, Moody’s to announce change

On Tuesday Israel’s sovereign credit rating was lowered by credit rating agency Morgan Stanley, and a special report on Israel’s economy is expected to be announced late Tuesday night, following the Knesset’s vote to pass the first law of its controversial judicial reform on Monday.

Morgan Stanley updated Israel’s sovereign credit to a “dislike stance,” noting that the government has reaffirmed the trajectory of its economy in a direction that is likely to scare off investors.

“We see increased uncertainty about the economic outlook in the coming months and risks becoming skewed to our adverse scenario,” the agency said. “Markets are now likely to extrapolate the future policy path and we move Israel sovereign credit to a ‘dislike stance.’”

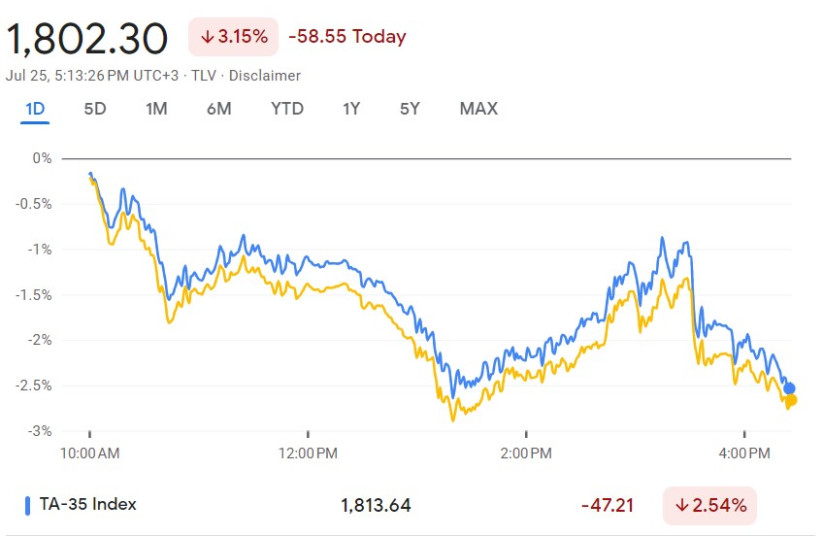

They added that recent events indicate “ongoing uncertainty” in Israel and that the shekel is likely to continue depreciating alongside the Tel Aviv Stock Market, which has lost nearly 10% since November of last year.

Screenshot of stock market activity the day after the first law of the judicial reform passed. July 25, 2023 (credit: screenshot)

Screenshot of stock market activity the day after the first law of the judicial reform passed. July 25, 2023 (credit: screenshot)Shoveling more problems onto the pile

Moody’s announcement will be made outside of its standard schedule for rating updates, which would have seen the next update in October. Given the outlook of Morgan Stanley and prior statements from Moody’s, the latter can likely be expected to demote Israel’s rating as well.

This would be Moody’s second downgrade of Israel’s economic outlook this year. In April, the agency affirmed Israel’s sovereign credit rating at “A1” but downgraded the outlook on the Israeli government’s credit ratings to “stable” from its prior status as “positive.” Moody’s cited “a weakening of institutional strength and policy predictability” and “a deterioration of Israel’s governance” as its primary concerns for Israel’s economy.

For months, hundreds of economists, experts, and executives throughout Israel and around the world have warned against the current government’s plan for judicial reform, claiming that it will lead to a sharp decline in foreign investment due to a lack of economic stability brought about by the weakened legal system.

Recent credit rating downgrades are only the latest signs of damage to the country’s economy. According to a report from Start-Up Nation Central published on Sunday, 68% of start-ups have already initiated steps such as withdrawing cash reserves, relocating their headquarters outside of Israel, moving employees abroad, and conducting layoffs in response to the judicial reform’s impending effects on the economy.

“Whatever your political views about it, what’s happening now in the country reflects big time on the business community. Now, doing business with Israel is a little bit more complicated, more risky, and that’s largely affected Israel’s overseas income,” Aman Group CEO Ben Pasternak told the Post. “Now, uncertainty is very large around the world as it is, but in Israel it’s even higher… Uncertainty kills business.”

Comments are closed.