China’s Madoff Economy Could Come Crashing Down — With Worldwide Effect; China Tips Into Deflation as Efforts to Stoke Recovery Falter

China’s Madoff economy could come crashing down — with worldwide effect:

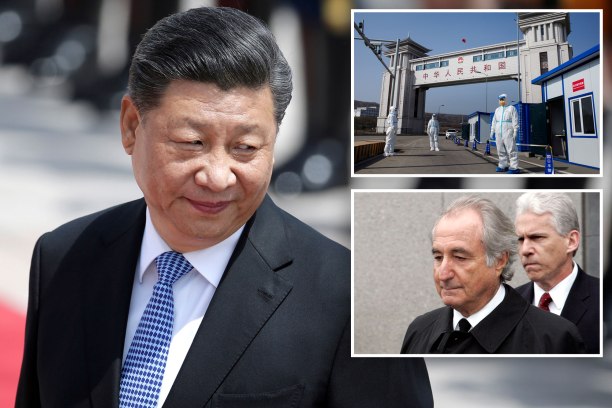

Not so long ago, China’s economy was known on Wall Street as the Madoff economy.

Like the infamous Bernie Madoff, who fictitiously reported stellar returns each year no matter what really happened to his investments, the Chinese government reported 7% to 8% growth each year no matter what really happened to the economy.

Little wonder then that many Wall Street analysts believed the country’s economy was growing much more slowly than the official numbers purported it to have done.

So how bad must the Chinese economy be that even the “official” numbers have dropped to 4% to 6%?

So bad that the Communist authorities are resorting to new sleight of hand.

They are instructing their local analysts, and they are putting pressure on the foreign investment banks, not to make negative comments on the economy.

It’s a misguided effort to boost domestic and foreign confidence, limit capital flight and prevent the economy from slipping into a deflationary downward spiral.

The country’s problems could have a material impact here in America, not least because China is the world’s second-largest economy and until recently was the world economy’s main engine of growth.

On the upside, a Chinese economy on the ropes could provide us with much-needed inflation relief through falling Chinese export prices and lower international oil and food prices. —>READ MORE HERE

China tips into deflation as efforts to stoke recovery falter:

China’s consumer sector fell into deflation and factory-gate prices extended declines in July, as the world’s second-largest economy struggled to revive demand and pressure mounted on Beijing to release more direct policy stimulus.

Anxiety is rising that China is entering an era of much slower economic growth akin to the period of Japan’s “lost decades,” which saw consumer prices and wages stagnate for a generation, a stark contrast to the rapid inflation seen elsewhere.

China’s post-pandemic recovery has slowed after a brisk start in the first quarter as demand at home and abroad weakened and a flurry of policies to support the economy failed to shore up activity.

The consumer price index (CPI) dropped 0.3% year-on-year in July, the National Bureau of Statistics (NBS) said on Wednesday, compared with the median estimate for a 0.4% decrease in a Reuters poll. It was the first decline since February 2021.

The producer price index (PPI) declined for a 10th consecutive month, down 4.4% and faster than the forecast 4.1% fall.

China is the first G20 economy to report a year-on-year decline in consumer prices since Japan’s last negative headline CPI reading in August 2021 and the weakness adds to concerns about the hit to business among major trading partners.

“For China, the divergence between manufacturing and services is increasingly apparent, meaning the economy will grow at two speeds in the rest of 2023, especially as the problem in real estate re-emerges,” said Gary Ng, Asia Pacific senior economist at Natixis. “It also shows China’s slower-than-expected economic rebound is not strong enough to offset the weaker global demand and lift commodity prices.” —>READ MORE HERE

Comments are closed.