Biden Just Invented a New Way to Rob Taxpayers for Student Debt Heist; Biden Has a Plan B for Student-Loan Forgiveness. The Courts Could Kill It, Too

Biden just invented a new way to rob taxpayers for student debt heist:

Biden is still pursuing mass loan forgiveness without the consent of Congress

After the Supreme Court ruled on President Biden’s illegal student loan bailout scheme, the scheduled return to loan repayment should have been straightforward: Interest began accruing on September 1st, and student loan bills should be due in October. This is the timeline set out by Congress and agreed to by President Biden as part of the debt ceiling deal signed in early June. Sadly, the president is yet again trying to circumvent the law so that borrowers can skip their payments with minimal penalties.

Instead of following the schedule, the Biden Education Department will allow for a one-year grace period in which borrowers who do not make loan payments will not be “considered delinquent, reported to credit bureaus, placed in default, or referred to debt collection agencies.” Interest still accrues, but it will not capitalize after the grace period. The Department of Education calls this a “safety net.” To Congress and to taxpayers, it’s a slap in the face.

The Biden administration seems to have forgotten that the payment pause and interest freeze is itself a safety net, and a generous one at that. By the time October 1t rolls around, the “emergency” policy will have lasted for 40 months, far longer than the emergency itself.

Everyone has known since June 3, when the president signed the debt ceiling bill, that borrowers would need to restart paying their loans in October. Based on the administration’s own communications, borrowers should have been prepared much earlier: In August of last year, Sec. Cardona told the public that the final extension would expire at the end of 2022. —>READ MORE HERE

Biden Has a Plan B for Student-Loan Forgiveness. The Courts Could Kill It, Too:

Education Department is trying to eliminate student debt using different legal authority after Supreme Court struck down president’s earlier program

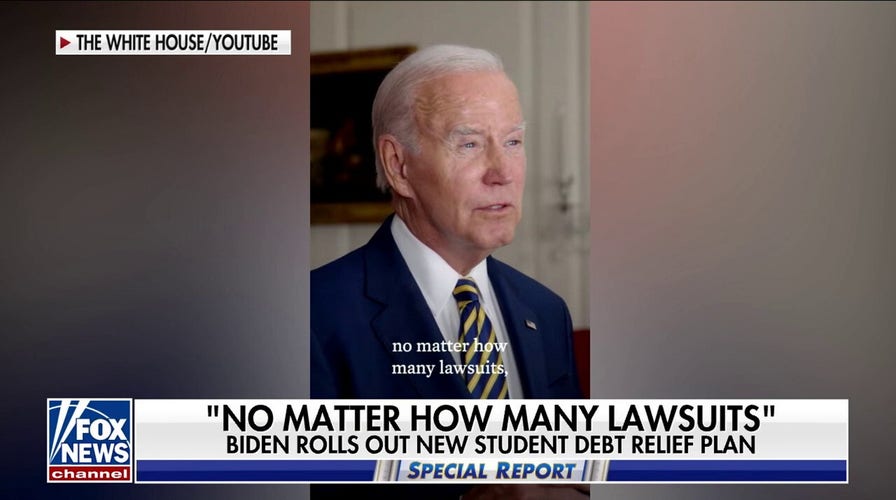

President Biden says he hasn’t given up on large-scale student-loan forgiveness. But the administration’s latest debt cancellation plan is far from a sure thing.

The Education Department this summer began an arcane regulatory process that officials hope eventually will offer millions of Americans a chance to erase part or all of their federal student-loan debt. The administration was forced to start from scratch after the Supreme Court ruled in June that the executive branch had exceeded its authority when it put in place a $430 billion plan to wipe away up to $20,000 in student debt for Americans making less than $125,000 a year.

The new debt forgiveness plan, which relies on a different legal authority, is likely to face similar legal challenges to the ones that killed the original effort. Unknown is exactly how many borrowers would be eligible for the program and what kind of relief they might receive.

The program might not be up and running before the 2024 election, and even if it is, legal challenges and possible injunctions could prevent it from being implemented. A Republican president likely would stop the effort in its tracks.

The lingering questions are adding to the uncertainty hanging over the roughly 40 million Americans with federal student loans as they prepare to resume loan payments next month for the first time in more than three years. The Education Department instituted a pause on the payments in March 2020 in response to the spread of Covid-19.

“It makes it hard to make long-term decisions and plans. It makes it difficult to think about the future,’ said Lina-Maria Murillo, 42 years old, an assistant professor at the University of Iowa with roughly $150,000 in federal student loans.

Malik Lee, an Atlanta-based certified financial planner, said he advises his clients not to bank on across-the-board loan forgiveness. “Personally, I don’t think it’s going to happen,” he said. He encourages people to take advantage of the Biden administration’s existing programs, such as a new plan that can halve borrower’s monthly student-loan repayments. —>READ MORE HERE

Comments are closed.