Report: Government Covid Handouts Screwed Over Low-Income Households By Spiking Inflation

For all the trillions of dollars spent during Covid lockdowns, what did taxpayers receive, other than massive amounts of fraud? A new analysis provides additional insight into how much of the spending was not only ineffective but unnecessary.

A recently released Congressional Budget Office (CBO) report demonstrates the wastefulness of the spending spree. On net, government transfers increased incomes along all levels of the spectrum, rich and poor. These giveaways not only gave money to people on the income spectrum who didn’t need it, but worsened our debt and deficits and unleashed the monster of inflation on the American people.

Poor Households Hardest Hit

The CBO report tracks changes in incomes from 2019 to 2020. In so doing, it examines the effects of the spending included in the multitrillion-dollar CARES Act and other legislation enacted by President Trump, a Democrat-controlled House of Representatives, and a Republican Senate. Because the analysis does not include 2021, it excludes the effects of the additional spending enacted by President Biden and Democrats in Congress in the spring of that year.

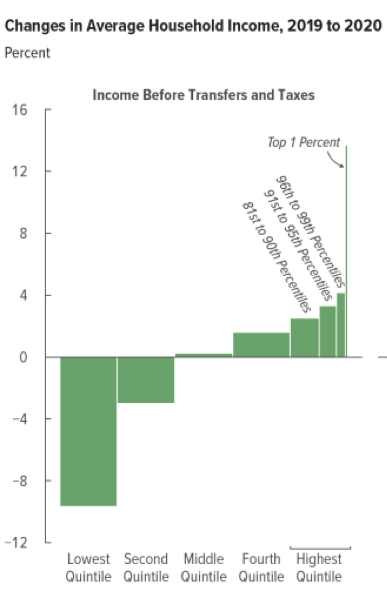

The report shows how low-income households bore the brunt of the economic effects of Covid lockdowns. In 2020, the income before taxes and government transfer payments in the lowest quintile (i.e., the lowest 20 percent of households on the income spectrum) declined from $24,200 to $21,900 — a drop of almost 10 percent.

By contrast, income before taxes and transfers for the three highest income quintiles actually rose. For the wealthiest quintile (i.e., the top 20 percent of household income), average income before taxes and transfers rose by more than 6 percent, from $337,400 to $357,800. And CBO notes that the income for the richest 1 percent grew by a far greater amount. In most cases, the income growth for wealthy households came via the rise in stock market prices prompted by multiple rounds of Federal Reserve money printing during the pandemic.

Explosion in Transfer Payments

On its face, the report provides justification for some levels of government assistance, so that people could stay afloat while bureaucrats shut down vast swathes of the economy. But the CBO analysis shows that on average, the benefits paid out vastly exceeded households’ economic losses.

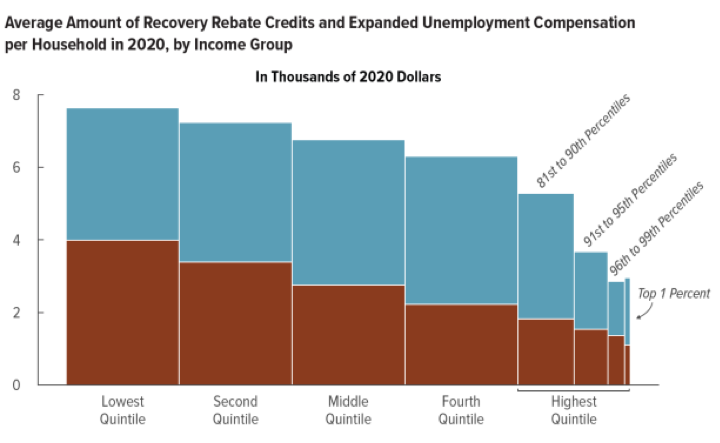

Just two pandemic programs — recovery rebate credits (i.e., “stimmies”) and enhanced unemployment compensation — provided an average of $7,000 to each household among the four lowest income quintiles. For those in the lowest quintile, benefits from these two programs averaged $7,600 per household. That’s more than three times the $2,300 the average household in this range lost in income before considering the effects of taxes and government transfer payments.

CBO notes that these programs increased means-tested transfer rates for the lowest income quintile from 65 percent in 2019 to 93 percent in 2020. “Total means-tested transfers received by households in that quintile equaled 93 percent of all their income before transfers and taxes.” In other words, low-income households received nearly as much from the government as they did from working. The CBO analysis also found that extended unemployment compensation — which paid people more money NOT to work — counted for most of the increase in transfer rates at the lower end of the income scale.

At the very top of the income scale, CBO found that pandemic-era transfer programs increased income by “only” $3,000. On the one hand, this data point shows that policymakers tried to target and means-test federal benefits to those most in need.

But on the other hand, why did Congress provide ANY new federal cash to well-heeled families who were already benefiting from the stock market boom prompted by the Fed’s money-printing efforts? It seems just as inefficient as paying low-income households vastly more in new transfer payments than they lost in income during pandemic lockdowns.

Higher Inflation, Higher Debt

The CBO report notes that all these additional government payments during 2020 ended up reducing income inequality. Incomes for all households actually rose during the pandemic, thanks to federal spending, but poorer households’ income grew by more on average than those of wealthier families.

But this government spending, coupled with the Fed’s money printing, also unleashed high inflation for the first time in decades. And inflation takes the biggest toll on low-income families, who spend far more on non-discretionary purchases (i.e., housing, groceries, utilities, transportation) that one cannot “cut back on” when prices spike.

To say this spending did anything more than worsen our two-headed monster of inflation and federal debt seems a stretch. Effectively throwing money out of a helicopter, as the federal government did during the Covid pandemic, may seem like a good idea. But the CBO report shows how much of the money was wasted indiscriminately, and in the process gave us a debt hangover that will last for decades to come.

Comments are closed.