Trillion-Dollar Deficits Explain Why Inflation Keeps Hitting American Families

Economists sounded surprised recently when inflation remained above expectations for the third straight month, likely keeping interest rates elevated for the foreseeable future. If they looked in Washington’s direction, they shouldn’t be.

Two reports from the Congressional Budget Office (CBO) explain the dilemma our economy faces. In the short term, significant and persistent deficits caused by Washington’s spending keep fueling the inflationary fire. In the longer term, the debt accumulated by all those deficits will make our economy stagnant for future generations.

Trillion-Dollar Deficit

The first CBO report examined the federal government’s financial accounts halfway into the fiscal year. Six months into the budget cycle that ends this Sept. 30, Washington has already racked up a deficit of over $1 trillion.

Granted, the federal government will likely run a surplus in April, given that many individuals either pay their remaining 2023 income taxes, and/or make quarterly estimated payments for their 2024 income taxes, on April 15. But CBO also notes that, after adjusting for various timing shifts, the deficit for the first half of the fiscal year exceeds last year’s fiscal shortfall.

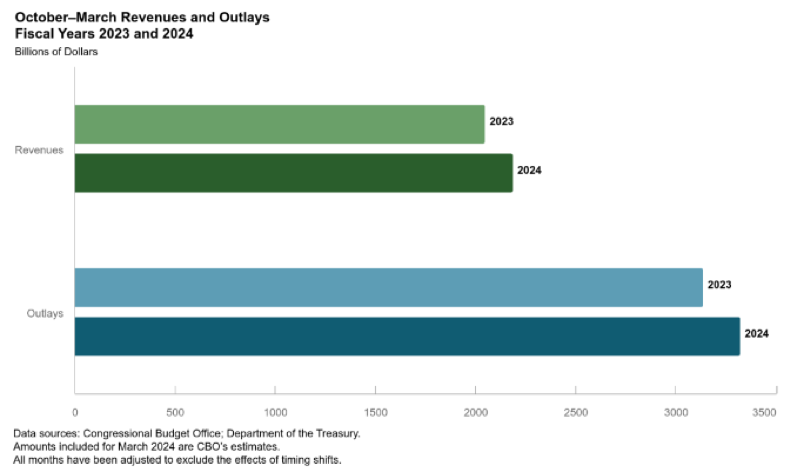

And even though Democrats would have you believe that tax cuts cause all fiscal ills, the growth in the deficit happened even as revenues grew by 7 percent. One chart from the CBO report shows both the growth of revenues compared to last year and the imbalance between revenues and outlays during the first six months of the fiscal year:

The biggest reason spending grew faster than revenues? The explosion in net interest costs on our accumulated debt. Net interest rose a whopping 43 percent compared to the comparable period last year, to $440 billion. The combination of debt from the Covid spending binge, and higher interest rates to combat the inflation all this spending caused, led Washington to spend more on interest costs in the first six months of the fiscal year than it did to fund Medicare benefits for seniors — and no, that’s not a typo.

And Bigger Deficits to Come

As bad as the current budget situation seems, it pales in comparison to the future woes our country faces. A CBO report released just before Easter analyzed the outlook over the next three decades and provided a forecast of a country that could become paralyzed by the economic and fiscal costs of servicing its debt.

The first sentence of the first chapter spells the tale: “In CBO’s projections, deficits are historically large.” The deficits occur on two levels. First, the nation runs historically large primary deficits — that is, spending exceeds revenues even after excluding interest costs. CBO also notes that these deficits “are especially large given the low unemployment rates that the agency is forecasting,” just as Washington ran a $2 trillion deficit last fiscal year when unemployment remained low.

Second, interest costs themselves double (even compared to the higher levels of the past several months) due to the combination of higher interest rates and more cumulative debt. That’s a nice way of saying that future generations will spend many decades paying for the choices our big-spending politicians have made in recent years.

Even the dire scenario laid out by CBO in many respects rests on favorable assumptions. For starters, the budget office presumes that one of the largest tax increases in history takes effect when major provisions of the Tax Cuts and Jobs Act expire at the end of next year, which will drive revenue as a percentage of GDP toward its all-time high.

In addition, CBO assumed that the spending caps enacted as part of last spring’s debt limit agreement would continue and keep discretionary spending lower well into the future. Under statute and convention, the Congressional Budget Office has to assume that current law policies continue into the future, but if you think Congress won’t go on another spending binge the second it has the chance, I’ve got some land I want to sell you.

Need for Spending Restraint

The CBO report on the long-term fiscal outlook explains just some of the ways our nation will suffer for its poor financial choices. Policymakers will have less room to respond during an economic crisis — and for that matter, could find themselves restrained financially to counter an attack by a foreign power or terrorist group.

The growth of our nation’s debt will also mean less growth for the economy as a whole. As government borrowing increases, private lending — one of the ways businesses can grow and invest — will decrease. In addition, the higher taxes necessary to service all this debt will weigh on the nation’s economic potential.

To prevent this “doom loop” from occurring, Congress needs to put the nation’s budget on a diet — and the sooner the better. If they do not, Americans may wake up one day to discover just how badly their political class has mortgaged the entire nation’s future.

Comments are closed.