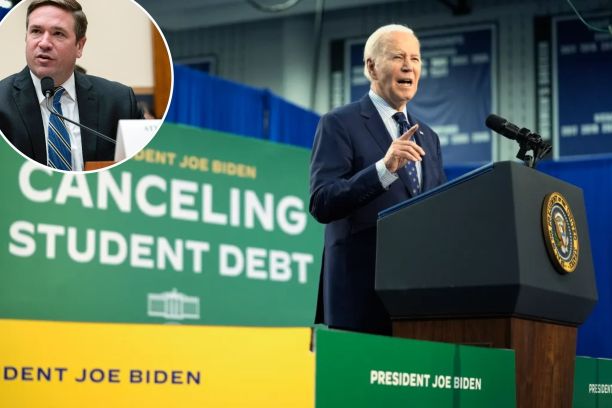

Courts Block Biden From Canceling Any More Student Loan Debt; Missouri, Kansas Judges Temporarily Halt Much of President Biden’s Student Debt Forgiveness Plan

Courts block Biden from canceling any more student loan debt

President Biden’s latest student loan bailout was blocked Monday by federal judges in Kansas and Missouri following a lawsuit from several Republican-led states.

The nationwide preliminary injunctions issued by US District Judges Daniel Crabtree in Kansas and John Ross in Missouri – both appointees of former President Barack Obama – prevent the Biden administration from canceling any more federal student debt for borrowers enrolled in the Saving on a Valuable Education (SAVE) plan.

The 81-year-old president’s Education Department will also be barred from implementing new SAVE plan provisions while the litigation plays out.

The judges did not call for debt relief already handed out to be clawed back.

Biden’s SAVE plan, which is expected to cost US taxpayers $475 billion over the next 10 years, aims to cut monthly income-based student loan payments in half and eliminate monthly payments for minimum-wage earners. For student borrowers who owe $12,000 or less, all outstanding debt would be forgiven after 10 years.

The University of Pennsylvania’s Penn Wharton Budget Model estimated that about 750,000 households making over $312,000 in average household income would benefit as well, seeing an average of $25,541.39 in debt relief under the SAVE plan, far above the $4,899.26 average.

Some $5.5 billion in student loan debt has already been forgiven under the plan, which was slated to fully take effect on July 1.

Both judges found that lawsuits led by Missouri Attorney General Andrew Bailey and Kansas Attorney General Kris Kobach were likely to succeed in arguing that Biden overstepped his authority when he bypassed Congress to implement the SAVE plan. —>READ MORE HERE

Missouri, Kansas judges temporarily halt much of President Biden’s student debt forgiveness plan:

Federal judges in Kansas and Missouri on Monday together blocked much of a Biden administration student loan repayment plan that provides a faster path to cancellation and lower monthly payments for millions of borrowers.

The judges’ rulings prevent the U.S. Department of Education from helping many of the intended borrowers ease their loan repayment burdens going forward under a rule set to go into effect July 1. The decisions do not cancel assistance already provided to borrowers.

In Kansas, U.S. District Judge Daniel Crabtree ruled in a lawsuit filed by the state’s attorney general, Kris Kobach, on behalf of his state and 10 others. In his ruling, Crabtree allowed parts of the program that allow students who borrowed $12,000 or less to have the rest of their loans forgiven if they make 10 years’ worth of payments, instead of the standard 25.

But Crabtree said that the Department of Education won’t be allowed to implement parts of the program meant to help students who had larger loans and could have their monthly payments lowered and their required payment period reduced from 25 years to 20 years.

In Missouri, U.S. District Judge John Ross’ order applies to different parts of the program than Crabtree’s. His order says that the U.S. Department of Education cannot forgive loan balances going forward. He said the department still could lower monthly payments.

Ross issued a ruling in a lawsuit filed by Missouri Attorney General Andrew Bailey on behalf of his state and six others.

Together, the two rulings, each by a judge appointed by former President Barack Obama, a Democrat, appeared to greatly limit the scope of the Biden administration’s efforts to help borrowers after the U.S. Supreme Court last year rejected the Democratic president’s first attempt at a forgiveness plan. Both judges said Education Secretary Miguel Cardona exceeded the authority granted by Congress in laws dealing with students loans.

Bailey and Kobach each hailed the decision from their state’s judge as a major legal victory against the Biden administration and argue, as many Republicans do, that forgiving some students’ loans shifts the cost of repaying them to taxpayers. —>READ MORE HERE

Comments are closed.