The Harris-Biden Admin Made America’s Debt Bomb Worse To Win An Election

The U.S. economy is slowing, and economic health is weaker than the Harris-Biden administration’s economic data has led investors to believe. Last week, the U.S. Bureau of Labor Statistics reported that the U.S. added 818,000 fewer jobs over the last 12 months (from March 2023 to March 2024) than previously reported. The largest reductions to estimated job-gains were in high-paying professional and manufacturing jobs, too.

A large reason for the miss is that the Bureau of Labor Statistics (BLS) has incorrectly estimated the start and death of businesses (the birth-death adjustment) since the Covid lockdowns and stimulus, which has incorrectly pushed estimates of job creation higher. The birth-death adjustment was likely skewed post-stimulus because of the many business entities opened to facilitate PPP (Paycheck Protection Program) loan fraud. This could mean a large number of added jobs since 2021 are fake. Even if the data is correct, most of the existing gains have gone to foreign born workers.

There are other signs of a slowing economy. The consumer is slowing, unemployment is edging higher (which is related to, but not exactly the same as the lower job-adds), and the yield curve is inverted (the yield on 2-year Treasury debt has been higher than the yield on 10-year Treasury debt), something that occurs before recession. Worse, a large part of post-Covid growth and job-adds (the real ones) have been fueled by government spending. This spending-binge is about to turn from a tailwind to a headwind.

An unprecedented federal spending binge

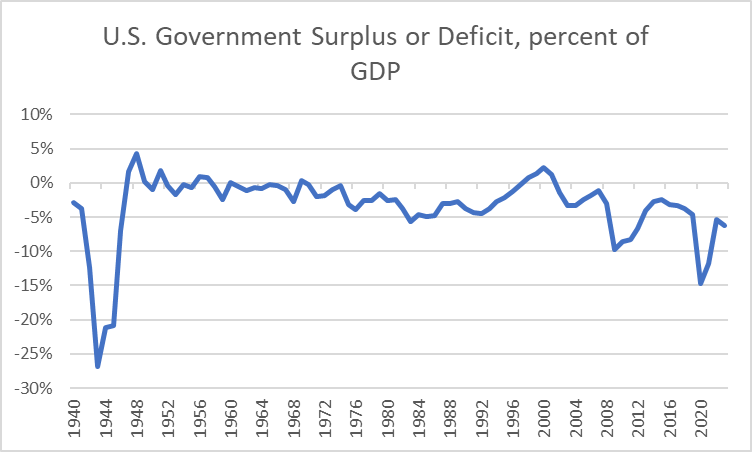

Given we aren’t in a major war and the economy is not in recession (markets are making all-time highs), federal government spending is completely off the rails. The best way to measure this is the overspending relative to taxes, relative to the size of the U.S. economy.

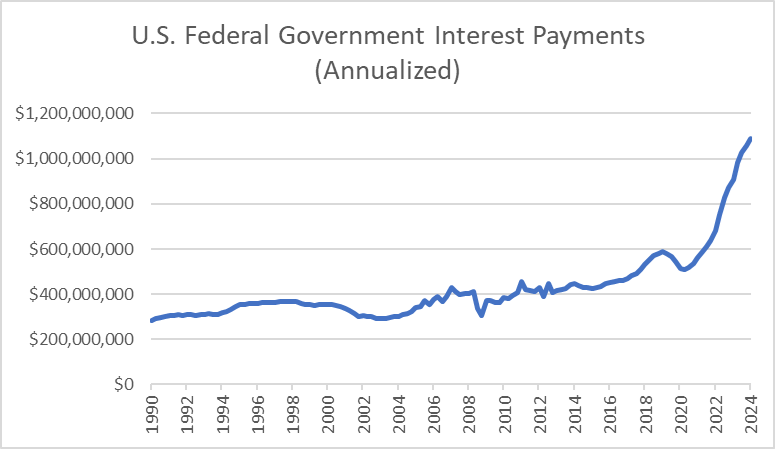

Federal spending in 2023 was $6.2 trillion, while receiving just $4.7 trillion in tax revenue — so the government spent $1.5 trillion more than it took in. Because of the increasing deficit, more debt is being issued (national debt is now over $35 trillion). This is resulting in skyrocketing interest cost to service the national debt. The government is now paying over $1 trillion per year just to service the debt load, an interest cost that will only increase, causing overall debt to increase in turn. There’s no end in sight to this spiral.

No free lunch on debt

Summing it up, debt is a real problem, and far more now than it ever has been since people started talking about the national debt in the last 20 years. Yes, all presidents add to debt, but the debt add under Biden and Harris is unprecedented in non-crisis times.

This debt issuance would normally pull liquidity out of private markets — like the public stock market — as newly issued government debt eats up more investment dollars, crowding out private assets. This could be a major headwind to the stock market and could have even started to tank the market over the last 12 months going into an election year.

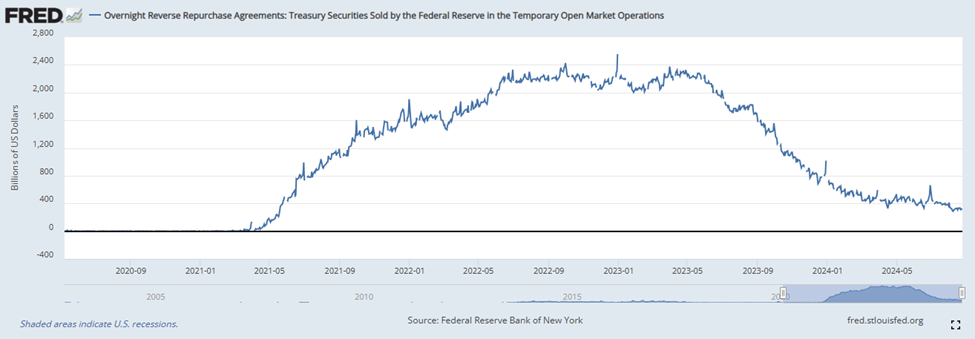

But enter something called Overnight Reverse Repo (ON RRP). ON RRP was a facility at the U.S. Federal Reserve (Fed) started during the Covid stimulus to solve the problem of negative rates in money markets (short term lending markets) because of the massive amount of Covid cash that had flooded the system. ON RRP paid a minimal interest rate so nobody would accept a lower interest rate than the rate offered by this ultra-safe Fed facility. This facility has soaked up excess cash in the system since 2021, and as the Fed has raised interest rates, the rate offered by the ON RRP has gone commensurately higher.

Janet Yellen’s debt fudge

Janet Yellen’s U.S. Treasury has, since 2023, purposefully issued ultra-short-term government debt at a place on the “curve,” meaning term of the debt (or time between issuance and maturity), to compete with the funds built up in the ON RRP. The debt U.S. Treasury is issuing is also at a slightly higher rate than ON RRP pays, enticing funds to flow out of ON RRP and into the newly issued short term Treasuries (T-bills). This has negated, or rather temporarily put off, the economic hit from all the government over-spending, until at least the ON RRP runs out. ON RRP likely runs out going into the U.S. election — there has been no net T-bill issuance for much of 2024, but the Treasury will need to raise significant funds this quarter — and of course the hope is that the facility runs out after the election.

The Treasury has explicitly admitted they are purposefully drawing down the ON RRP, but they call this “supporting liquidity” while they hope that the Fed starts to purchase (monetize) more U.S. government debt once the facility runs out.

What’s wrong with this? For one, in trying to support liquidity (the stock market) before an election, the Treasury has only been issuing very short-term debt, because only the very short-term debt will pull money out of the ON RRP. But short-term debt costs more and requires the government to constantly roll the debt over, exposing the government to potentially far-higher interest payments in the future.

Second, ON RRP’s funds won’t last forever. Instead of fixing the problem, or talking about it in an election year, Yellen has delayed the issue in a way that will make it worse for the country in the long run (the modus operandi of Washington). ON RRP soon running out is likely also a factor in the recent market volatility.

Finally, we have yet another example of why all the talk about “preserving America’s institutions” is hogwash. America’s institutions are rotten to the core, especially when run by the party of America’s ruling elite (the modern-day Democrat Party). These institutions, from the Fed to the Treasury, to the federal blobs that report economic data, consistently serve the connected and powerful. Here, the U.S. Treasury has very blatantly played games to re-elect Democrats at the expense of what is good for the United States. Normal Americans will be left to pick up the pieces once again. If Trump-Vance win, these institutions need to be put on the right track. For starters, more investigation should be done to examine how much the Federal Reserve has gone along with this irresponsible gamesmanship.

This individual is granted anonymity since publishing an article on The Federalist would credibly threaten close personal relationships, their safety, or their jobs. We verify the identities of those who publish anonymously with The Federalist.

Comments are closed.